We were discussing the other day how rich one would be if they had invested in Apple stock as soon as it became publicly available on December 12, 1980. Many articles have been written on the subject highlighting the astronomical returns an investor would have made on this iconic company. Some articles compare Apple returns against the “investment” one would make in their home over the same period. As we know being a homeowner is very different than being a real estate investor. I want to go beyond the numbers in this article. Looking back at 1980, it is an easy decision to invest in Apple. Which of today’s stock is the Apple of the future? Welcome to a tale of two investors.

I thought it would be fun to contrast how a real estate investor would have faired against a hard core Apple investor who would keep the stock for 45 years no matter what. Remember Apple had its share of problems: product failure, market share decline, change in CEO, poor acquisitions, financial issues, lawsuits, Microsoft bailing them out, stock market crash, financial crisis, etc. By the end of this article you will able to determine the best investment for the next 45 years. To better illustrate the two investment strategies, let me introduce our two investors. Mr. McIntosh who will be investing in Apple Stock and Mr. Moore who will be investing in real estate.

To be fair, let’s setup some rules for our two investors

Their ultimate goal is to maximize Equity, their wealth.

They can reinvest the revenues derived from their investment. Dividends, net cash flow.

They are not speculators so do not profit directly from the ups and downs of the market or interest rate.

We are giving Mr. McIntosh a big advantage. He already knows that Apple will be a massive success so he doesn’t have to worry about looking at other stocks.

We also included the depreciation tax advantage in our calculations.

Our story begins in December 1980, when Mr McIntosh tells Mr Moore of a hot tip he received from his stock broker (remember those) about this new company, Apple. They have been making and selling personal computers for about 3 years and they were about to launch their initial public offering (IPO which means that they issue stocks to the public for the first time). It was not clear at that time if PC had any use beside playing games.

1980

On December 12, 1980, Apple stock hits the market and Mr. McIntosh decides to purchase 200 shares at $22/share ($4,400 total or about $14,000 in today’s dollar) and tries to convince Mr. Moore to do the same. I chose $4,400 as initial investment so that Mr. McIntosh would start with 200 shares even. Mr. Moore is a more traditional investor and purchases a single family rental for $17,000 and uses his $4,400 as a down payment (25.8% down). Mr. Moore optimized his house purchase so it would provide a small positive cashflow annually. Mr. Moore manages to secure a mortgage at 13.74% (Source: FreddieMac). The house is rented for $250/month. After all expenses, property management costs, and the mortgage are paid Mr. Moore basically breaks even with a small Net Cash Flow of $10. This represents a 10% capitalization rate (CapRate) which is the average of the properties that we sell on MartelTurnkey.

At the end of the day, our two investors meet for dinner and discuss their respective investments. As you can see, both investors have $4,400 in equity.

Mr. Moore was able to use leverage to secure a bigger asset position. A few days later, Apple’s share price dropped to $19.40. On paper, Mr. McIntosh lost $500 in equity but he continues to hold the stock because he is a value investor and is not concerned by these short term fluctuations in stock price.

1985

Mr. McIntosh was seriously concerned to read in the financial newspapers that Apple CEO, Steve Jobs, was kicked out of Apple. Steve Jobs retaliated by starting a new company, NeXT that will compete directly with Apple. What will happen to Apple without its co-founder? How will it affect the stock price? How big a threat is NeXT? Mr McIntosh has a lot of questions but no one can really answer. He continues to hold on to the stock.

1987

Our two investors stay in touch over the years, and on June 6th, 1987 Mr. McIntosh invites Mr. Moore for dinner to celebrate the $0.12/share dividend he had received a few weeks earlier and the recent Apple stock split. After the split, Mr. McIntosh has 400 shares valued at $41.50/share and decides to reinvest his $48 dividend by buying one additional share of Apple. Mr. McIntosh’s equity is now valued at $16,641.50 representing almost 21% annualized return which is significantly higher than S&P or Dow Jones estimated returns. Below is a comparison of our investors’ positions at the end of 1987. Please note that Mr Moore’s asset number includes the value of his property ($24,078) and $3,058 of cash accumulation (without interest) of net cash flow and the tax impact of depreciation.

However, Mr. Moore has built more than just equity, he also created a passive stream of income (Net Cash Flow) from his rental property.

Mr Moore explains that his house value appreciated at the same rate per year as the US national House pricing index. His property manager always kept the rent current and increased them annually based on inflation. The next day, Mr. Moore decides to take advantage of the much lower mortgage rate 10.34% to refinance his property for 80% of its value or $19,262 and pays back the balance of his previous mortgage of $11,973 leaving Mr. Moore with net proceeds of $7,289. Coupled with his $3,058 in cash, Mr. Moore has $10,347 cash and he decided to purchase 2 more identical rental houses for the current market price of $24,078 each. He finances the two houses and put 20% down or $9,631. After these transactions are completed, Mr. Moore is left with $716 in cash and the details of these transaction to his balance sheet are printed below.

From 1988 to 2000

During that period, Apple stock went up and down as stocks do and Apple continued paying dividends until November 1995. Mr McIntosh stays abreast of what Apple is doing by reading newspapers and news on the internet. Apple announces multiple acquisitions including the acquisition of Steve Jobs’ company NeXT in December 1996. Apple retains Mr. Jobs as an advisor and in 1997 Steve Jobs steps in as interim CEO. The company is near bankruptcy and is bailed out by Microsoft in an astonishing deal. In the face of all this uncertainty, poor company performance, product failures, change in leadership, Microsoft bail out, etc Mr. McIntosh not only continues to hold Apple stock but reinvest the dividends by purchasing 36 more shares of Apple. In June 2000, Apple splits again and the price after the split is $55.62. Here is the Mr. McIntosh’s position after the split.

Mr. Moore on the other hand continues to receive positive cashflow and uses the cash flow as down payment to acquire additional properties. To illustrate, in 1990, Mr. Moore owned 3 properties for a total rent of $12,940 a year which provides a net cashflow of $1,360 once all expenses and mortgage are paid. The 3 properties also give Mr Moore a tax credit for depreciation of $710.

At the end of 1990, Mr Moore has $5,800 in cash when you include the $3,700 in cash he already had at the beginning of the year. Mr Moore has enough cash to acquire another rental property at $27,911 ($5,582 as down payment).

At the end of 1991, Mr Moore receives $1,924 in net cash flow. At the end of 1992, Mr Moore receives another $2,248 in net cash flow and when combined with $1,924 in previous year’s cash flow and cash left at the end of 1990, Mr Moore now has $6,415 which affords him the down payment for another rental unit.

Mr Moore continues to acquire as many rental units as he can afford each year and at the end of 2000 Mr Moore managed to own a total of 14 units in his portfolio.

Net Cash Flow on 14 unit Portfolio

When comparing the $247k in equity created by Mr Moore’s with the $48k created by Apple for Mr McIntosh’s, there is no denying that Mr Moore is in a better position. This comparison does not even consider the present value of future cash flow for Mr. Moore.

At the end of 2000

Only a few months after their meeting, Mr. McIntosh’s financial picture has changed significantly. The stock market crash of 2000 saw Apple stock price go down to $14.80 by the end of December. Mr. McIntosh’s equity goes from $48,611 to $12,935 which is significantly lower than what it was in 1987. This is a significant blow to Mr McIntosh finances. He doesn’t have too many choices, he could sell and realize a loss, invest more but he doesn’t have the money. For the purpose of our story, he continues to hold on. Many investors moved out of the stock market and headed for bonds or Real Estate.

Mr Moore on the other hand is unaffected by the crash and decides to take advantage of the low mortgage rate to refinance his rental units and use the cash to acquire additional rental units. Mr Moore can get a loan for about $435k (80% of $544,620). The net proceeds of the loan would be about $117k (435k – existing loan 318k). So Mr Moore now has $138k ($117k plus cash on hand $21k) to acquire additional rental units. The current price of the units are about $39,000. Mr Moore needs to put a down payment of $7,780 for each rental unit. Since Mr Moore has $138k cash he can purchase 17 rental units! At the end of the transaction Mr Moore’s balance sheet looks something like this.

With this kind of cash flow and considering that he needs $8,300 as down payment, Mr Moore continues to acquire rental units very rapidly. In fact he is accelerating the pace of his acquisitions.

2001 to 2005

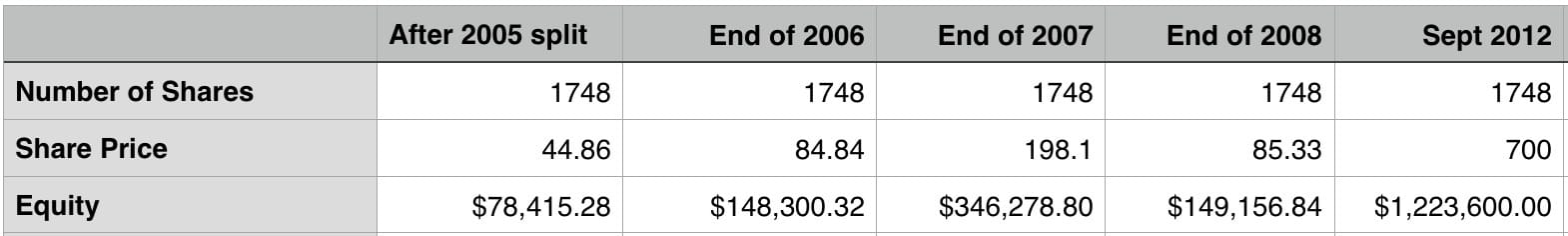

Things are going well for Apple during that time. Apple introduces the iPod in 2001, opens retail stores and iTunes in 2003. On February 28th, 2005, Apple announces a 2 for 1 stock split. The stock closes at 44.86 after the split.

Mr Moore uses his net cash flow to acquire additional rental units. At the end of 2001 his $27k of cash flow allows him to acquire 5 more rental units with a down payment of $41,881. The net cash flow increases every year and by the end of 2005 Mr Moore has 54 rental units in his portfolio with $84k of cash on hand and a net cash flow of almost $60k per year. Below is a table comparing each investor’s equity and their respective annualized returns.

At the end of 2005 Mr Moore decides to refinance and reinvest the cash by acquiring additional rental units. Each rental unit needs about $11,000 in down payment so Mr Moore acquire 14 rental units. The table below outlines his position before refinance, after refinance, and after refinance and acquisition.

After this acquisition, Mr Moore’s net cash flow is raised to $25k (as shown below).

At the end of 2005, Mr Moore continues to reinvest in his business. He uses the $10k in cash left after the acquisition in addition to the $25k of cashflow to acquire 5 more rental units.

Great Financial Crisis of 2008

We started seeing the effect of the Financial crisis in 2007 where the real estate values went down by 5.6%. In 2008 the housing value went down by 8.5%. These reductions were the sparks that ignited the financial crisis. The reduction in asset value along with subprime mortgages, Mark-to-Market rule, derivatives valuation, and other factors brought the biggest financial crisis ever seen.

Mr Moore didn’t escape the crisis. The table below illustrates how Mr Moore’s assets were impacted with the first column showing the balance sheet at the end of 2006 representing the highest asset valuation while the next 2 columns shows how the drop in real estate affected his equity. You will notice that the reduction in equity is dampened by the positive net cashflow and the principal payment on existing mortgage.

Like all investors, Mr Moore is concerned by the events unfolding and he does not acquire additional properties until 2012 when the real estate market started recovering. This very conservative assumption means that Mr Moore will not be able to acquire assets at a lower price. Mr Moore could also use the cash to pay down his loans but he just sits on his cash at 0% interest. Some homeowners seeing their property value underwater decided to stop paying their mortgage, and the banks began widespread foreclosure.

As you can see from the table above, the asset value was reduced by almost 20%. The negative of housing value was dampened by positive net cash flow, and normal reduction in principal from mortgage payment. The tenants renting Mr Moore’s apartments still needed a place to live so the rental income was not affected by the crisis, Mr Moore continued to pay his mortgages even if some of his properties were under water so the bank didn’t foreclose on him. As you can see below Mr Moore is still generating strong positive cashflow.

Mr McIntosh is jubilating at how well Apple stock is doing. Only a few years ago his position was worth $78k and his equity nearly doubled every year in 2006 and 2007. By the end of 2008 however Mr McIntosh saw the value of his portfolio cut in half only to see astronomical growth until 2012. We’ll get to that in the next section.

Once again it is pretty clear that Mr. McIntosh is at the mercy of the stock market, the economy, the news, the banks, the government, the federal reserves. Mr. Moore is not as impacted by the fluctuations and has more flexibility to protect his assets and take advantage of opportunities.

2012

In 2012, the housing prices nationwide stopped going down and investors began to slowly warm up to investing again. Interest rates were low, the banks and the auto industry were saved. At the end of 2012, Mr Moore had accumulated a significant amount of cash as shown by the table below so he decides to refinance his portfolio and use his cash to acquire 80 more rental units.

Net Cash Flow on 153 unit portfolio

2014

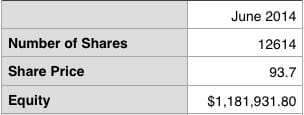

In 2012, Apple started paying dividends again and Mr McIntosh reinvested his dividends at the end of each year by purchasing additional shares. When Apple announced a 7 for 1 stock split in 2014, Mr McIntosh had accumulated 1802 shares. The price price per share after the split is $93.70. Mr McIntosh is extremely pleased with the result of his investments so far.

During 2013, Mr Moore acquires 30 more rental units and at the end of 2014 he is able to acquire an additional 47 rental units.

2018

As Apple continues to pay dividends every quarter, at the end of each year Mr McIntosh uses the proceeds to acquire more shares and in 2018 Mr McIntosh managed to accumulate 13,411 shares of Apple. Currently, each quarter Apple pays $0.63/shares so Mr McIntosh receives annual cashflow of $34,000. We put a question mark beside that cash flow number because this cashflow is uncertain since Apple decides how much it will pay in dividends. In fact, Apple can decide to stop paying dividends altogether like it did in 1995.

To summarize Mr McIntosh’s equity position increased from $4,400 to $2,264,000 over 37 years which represents an annualized returns near 18%. This is a much more significant return than the S&P which is 11.3% with dividend reinvestment

On the other hand Mr Moore has achieved financial freedom and beyond. He continued to reinvest his cashflow every year and at the end of 2018 Mr Moore is the CEO of a Real Estate empire holding $27M in assets. Mr Moore not only generated $10M in equity with a 22% annualized returns he also has created a company that generates almost half a million a year in net cash flow.

Global Pandemic of 2020 to today

When the world shut down in 2020, everything changed, except the rules of wealth. Apple stock plunged briefly, then exploded to new heights as remote work, online everything, and a flood of stimulus money pushed tech valuations into orbit. Mr.Moore faced a different reality: rent moratoriums, supply shortages, and record-low interest rates that sent housing prices soaring.

Yet underneath the chaos, both investors faced the same test of resilience.

Mr. McIntosh had to trust the innovation cycle and the Apple would figure out a way to survive. Mr Moore had to adapt to uncertainty, shifting markets, and new tenant behaviors. Those who stayed calm, diversified, and focused on long-term fundamentals came out stronger.

The U.S. economy then found itself wrestling with inflation hovering between 7% and 8%, levels not seen in decades. Everyday essentials, from groceries to gas, became noticeably more expensive, eroding consumer purchasing power and confidence. To counter this surge, the Federal Reserve raised interest rates aggressively, pushing mortgage rates into the 6–7% range. For Mr. Moore, it was a new environment where cash flow mattered more than appreciation, and disciplined underwriting once again became the difference between profit and pain.

By the end of 2024, Mr Moore grew his rental portfolio from 403 units at the end of 2018 to 1,000 units at the end of 2024. His NCF also grew dramatically from 465,000 a year to $2M a year.

During that same period, Mr. McIntosh rode a wave of volatility. After soaring during the pandemic, Apple’s stock stumbled in 2022, dropping roughly 26% as rising interest rates and inflation cooled enthusiasm for high-growth tech. But unlike many speculative companies, Apple rebounded quickly, gaining nearly 50% in 2023 as investors flocked back to quality names with strong balance sheets and loyal customers. The company’s massive cash reserves, relentless share buybacks, and expanding services business helped it weather the storm.

By the end of 2024, our investors are finding themselves in very different positions even though it doesn’t appear to be that different from an annualized returns perspective. Mr Moore only earned 2% more annually but over 45 years this additional 2% cause Mr. Moore’s Equity to be double that of Mr.McIntosh. Another element that is not so visible is that Mr.Moore earns a Net Cash Flow of $2M per year while Mr. McIntosh earns only 1 tenth of that with $222,000 in dividends. Mr. McIntosh still needs to have a job or start selling some of his share to live a better life while Mr. Moore has more than enough. In fact Mr. Moore could have stopped working 12 years earlier.

Conclusion

It should be clear by now that even an investor with a crystal ball, like Mr. McIntosh, is no match for an ordinary real estate investor like Mr. Moore. No other investors knew in 1980 that the Apple stock will be worth 1,500 times more 45 years later. As we’ve demonstrated not many investors would stick to the same investment for 45 years considering that the company changed CEO, started to lose money and market share, on top of the regular ups and downs of the market and the economy.

We’ve seen that a real estate investor:

Controls the outcome: they’re not just a shareholder but the CEO of their own wealth, deciding when, where, and how to grow it.

Multiplies results through leverage: using other people’s money to acquire bigger assets that accelerate both equity growth and cash flow.

Supercharges returns: by reinvesting profits strategically, turning every dollar of cash flow into more property, more income, and more freedom.

Achieves true financial freedom through steady, predictable positive cash flow, not paper gains.

Generates passive income that dwarfs stock dividends, because real estate doesn’t just pay you—it pays you monthly, reliably, and with leverage.

Builds a lasting legacy, creating a real, tangible enterprise of appreciating assets that can be passed down for generations.

If you want to get started investing in Real Estate just like Mr. Moore, download my Investor Game Plan and book a call with me.